Configure tax classes and tax calculation for your repair shop.

Accessing Tax Settings

- Navigate to Admin > Settings

- Click on Tax tab

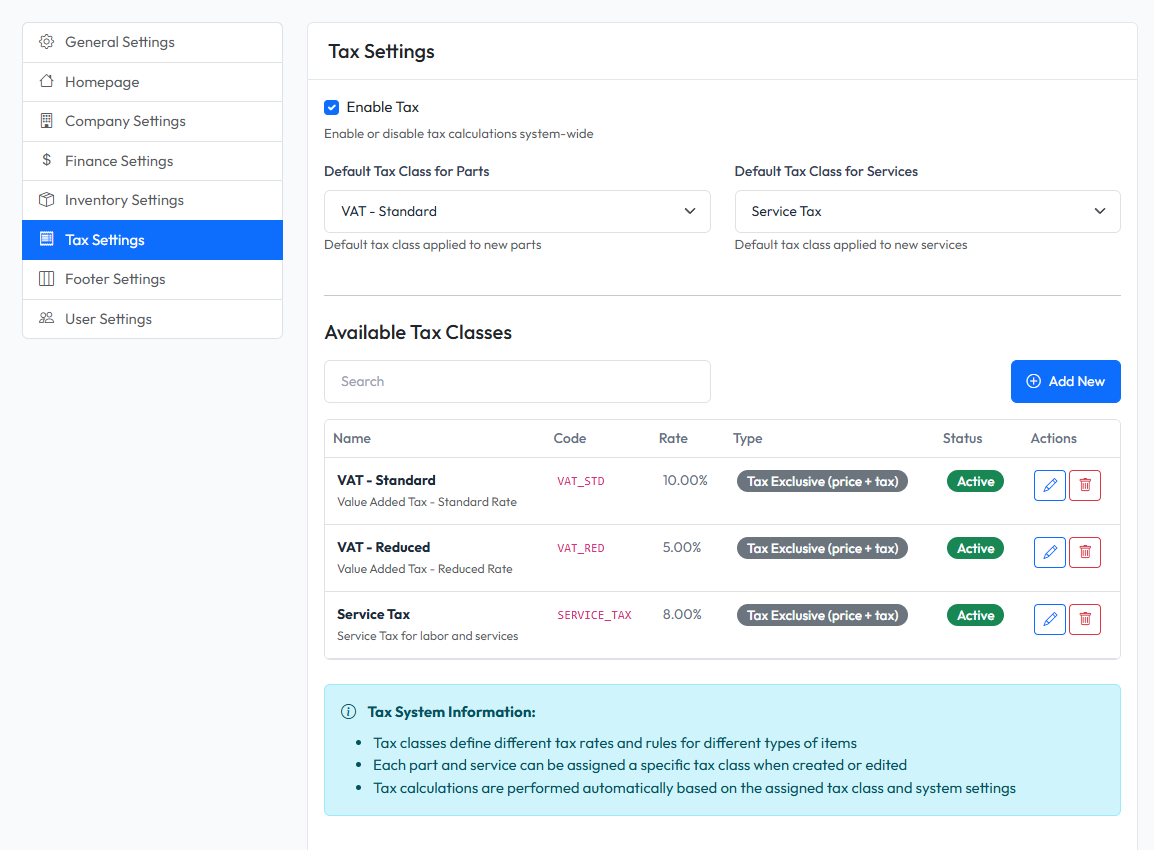

Enable/Disable Tax

Toggle the Enable Tax checkbox to turn tax calculation on or off globally.

When disabled:

- No tax is calculated on orders

- Tax columns are hidden from invoices

- All prices are displayed without tax

Default Tax Classes

Set default tax classes that will be automatically applied:

| Setting | Description |

|---|---|

| Default Tax for Parts | Tax class applied to parts by default |

| Default Tax for Services | Tax class applied to services by default |

Managing Tax Classes

Tax classes define different tax rates and calculation methods.

Viewing Tax Classes

The tax classes table shows:

- Name - Display name (e.g., "VAT - Standard")

- Code - Unique identifier (e.g., "VAT_STD")

- Rate - Tax percentage

- Type - Inclusive or Exclusive

- Status - Active or Inactive

Creating a Tax Class

- Click Add New button

- Fill in the form:

- Name - Descriptive name

- Code - Unique code (letters, numbers, underscores)

- Rate - Tax percentage (0-100)

- Type - Tax Inclusive or Exclusive

- Calculation Method - Per Item or Subtotal

- Rounding Mode - Round, Ceiling, or Floor

- Click Save

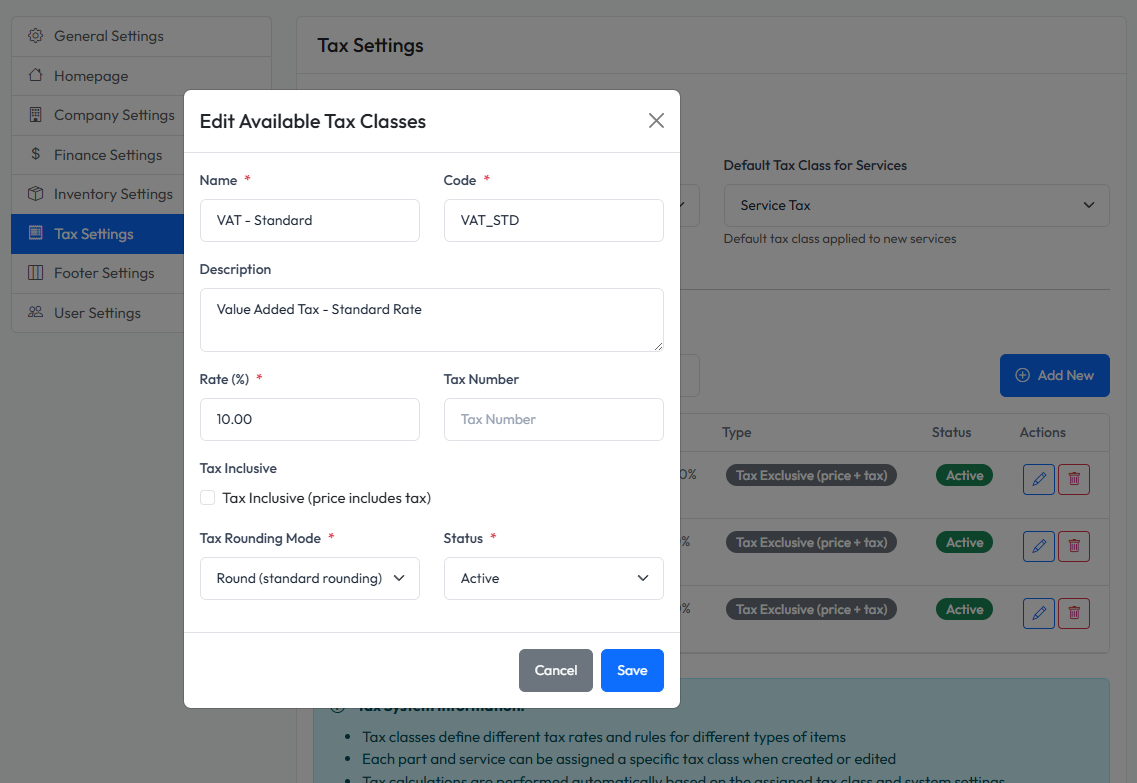

Tax Class Fields

| Field | Description |

|---|---|

| Name | Display name for the tax class |

| Code | Unique identifier (cannot be changed after creation) |

| Rate | Tax percentage (e.g., 10 for 10%) |

| Tax Inclusive | If checked, prices already include tax |

| Calculation Method | How tax is calculated |

| Rounding Mode | How to round tax amounts |

Rounding Modes

- Round - Standard rounding (0.5 rounds up)

- Round Up - Always round up

- Round Down - Always round down

Editing a Tax Class

- Click Edit button on the tax class row

- Modify the fields (Code cannot be changed)

- Click Save

Deleting a Tax Class

- Click Delete button on the tax class row

- Confirm deletion

Warning: Deleting a tax class may affect existing orders that use it.

Toggle Status

Click the status badge to toggle between Active and Inactive.

Inactive tax classes:

- Cannot be selected for new items

- Still apply to existing orders

Common Tax Configurations

Vietnam (VAT 10%)

| Field | Value |

|---|---|

| Name | VAT |

| Code | VAT |

| Rate | 10 |

| Tax Inclusive | No |

| Calculation | Subtotal |

| Rounding | Round |

No Tax

| Field | Value |

|---|---|

| Name | No Tax |

| Code | NO_TAX |

| Rate | 0 |

| Tax Inclusive | No |